Alright, let's dive into this "guide" to the best new crypto coins for December 2025. Bitcoin at $91K, new ETFs live...sounds like a party, right? Except, I've seen this movie before. It always ends with someone holding the bag.

New Crypto "Innovations": Same Scams, Different Lipstick

The Usual Suspects, Rebranded First up, Bitcoin Hyper (HYPER). A Layer 2 for Bitcoin built on Solana? So, it's like putting a Ferrari engine in a Yugo? They raised almost $29 million to "expand Bitcoin’s capabilities." Translation: they want to make Bitcoin do things it was never designed to do in the first place. Staking with 43% APY? Come on. If it sounds too good to be true...you know the rest. How long until that APY gets slashed to nothing? My guess? Sooner than you think. Then there's Maxi Doge (MAXI). Doge meme aesthetic meets gym and trading culture? This is what happens when you let the internet design a financial instrument. "Access to the Maxi Doge Alpha Group"? I bet that "alpha" is just a bunch of dudes giving each other terrible trading advice. Staking with 77% APY? Seriously? Are they even trying to hide the Ponzi scheme vibes? PEPENODE, an Ethereum meme token with a mine-to-earn game. Okay, I'm officially dead inside. Staking tokens to activate virtual nodes? It's like Farmville for crypto bros. I'm sure it'll be revolutionary...for someone. Ethena (ENA) is the only one here I *almost* respect. A synthetic stablecoin pegged through delta-neutral hedging? Sounds complicated, and it is. But the fact that its market cap is $4.8 billion and it's still down 80% from its all-time high…that's a red flag the size of Texas. Whales dumping $28 million worth of tokens? Yeah, that inspires confidence.DeFi "Innovation": Same Scam, New Wrapper

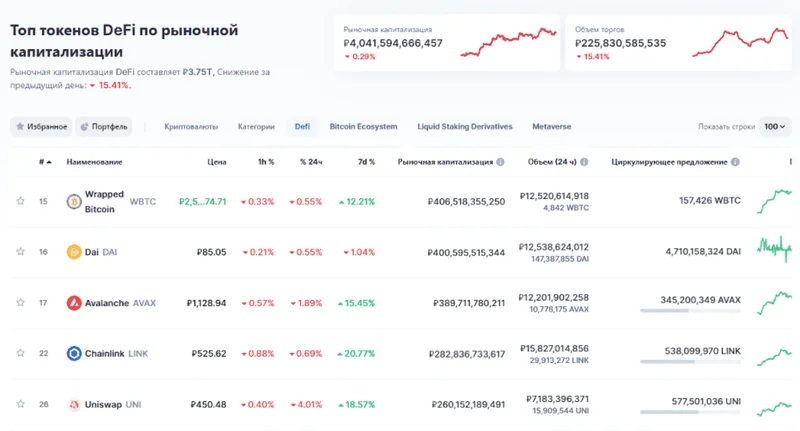

The "Innovation" That Isn't BEST Wallet Token, SUBBD, Drift Protocol, SpacePay, Hyperliquid, Aster… the list goes on. Promises of lower fees, boosted staking, direct creator monetization, high-frequency derivatives trading, and accepting crypto payments through Android POS terminals. It's all so exciting! It's also all been tried before, in slightly different forms. And how many of those previous attempts are still around? Exactly. Drift Protocol is getting praise for fast execution and safety. But, why hasn't $23M in protocol revenue translated to token value? I'm asking the real questions here. Hyperliquid's $314M token unlock is also generating some "intense debate." You know, the kind where some people are calling for transparency and others are defending the team. I wonder which side is winning. Aster's community discussions are focused on DefiLlama delisting them over suspected wash trading. Wash trading! Now there's a surprise. DeFi market growth is projected to explode. Cathie Wood predicts a $20 trillion crypto market cap by 2032. Maybe she's right. Maybe I'm just a grumpy old cynic. Then again, maybe I'm not the one trying to sell you something. So, What's the Real Story? All this "innovation" boils down to one thing: trying to find new ways to separate people from their money. Layer 2s, DeFi hubs, meme coins... it's all just window dressing. The fundamentals are still the same: buy low, sell high, and hope you're not the last one holding the bag when the music stops. This ain't new. It's just crypto doing what crypto does.